India's rapid digital transformation has propelled it into the global economic spotlight. However, this digital revolution has also made its citizens increasingly vulnerable to cyberattacks. From phishing scams to ransomware, the threat landscape is evolving rapidly. To mitigate the financial and emotional repercussions of such attacks, personal cyber insurance has emerged as a crucial safety net. Recognizing the growing vulnerability of employees, forward-thinking organizations are now incorporating Employee Cyber Benefits into their compensation packages. This article delves into the rising tide of personal cyber insurance frauds in India, the imperative for Employee Cyber Benefits, and strategies for creating effective programs.

The Rising Tide of Cyber Frauds in India

India's burgeoning digital landscape has unfortunately made it a prime target for cybercriminals. The sophistication and frequency of cyberattacks have surged, resulting in significant financial losses and emotional distress for individuals.

Common Types of Cyber Frauds in India

- Phishing and Smishing: These scams involve fraudulent emails or SMS messages designed to trick individuals into revealing personal information or clicking on malicious links.

- Online Shopping Fraud: Fake online stores and fraudulent payment gateways are used to deceive consumers into making unauthorized purchases.

- Identity Theft: Cybercriminals steal personal information to assume victims' identities, leading to financial loss and damage to reputation.

- Loan and Investment Scams: Fraudsters promise lucrative returns on investments or offer easy loans, often targeting vulnerable individuals.

- Social Media Scams: Cybercriminals exploit social media platforms to spread misinformation, steal personal data, or extort money.

How Fraudsters Operate

Cybercriminals employ a variety of tactics to deceive their victims:

- Social Engineering: Manipulating people into divulging sensitive information through psychological tactics.

- Malware and Ransomware: Infecting devices with malicious software to steal data or hold it hostage for ransom.

- Data Breaches: Exploiting vulnerabilities in systems to access personal information.

- Sim Swapping: Illegally porting a mobile number to another SIM card to access financial services.

The Impact of Cyber Frauds on Individuals

The consequences of cyber fraud can be devastating for individuals:

- Financial Loss: Victims often suffer significant financial losses due to unauthorized transactions, stolen funds, and fraudulent purchases.

- Identity Theft: The misuse of personal information can lead to identity theft, impacting credit scores and financial reputation.

- Emotional Distress: Cyberattacks can cause anxiety, stress, and loss of trust in digital platforms.

- Time and Effort: Victims often spend considerable time and effort recovering from the aftermath of a cyber fraud.

The growing prevalence of cyber fraud underscores the urgent need for individuals to adopt robust cybersecurity practices and consider protective measures like personal cyber insurance.

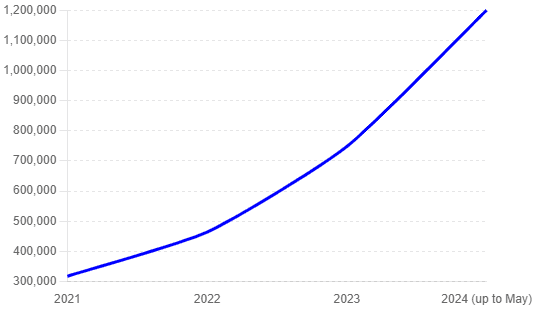

The Indian Cyber Crime Coordination Centre (I4C) reports a significant surge in cybercrime complaints in 2024, with an average of 7,000 complaints recorded daily in May 2024. This represents a 113.7% increase compared to the 2021-2023 period and a 60.9% increase from 2022 to 2023. 85% of these complaints are related to financial online fraud.

The Need for Employee Cyber Benefits

The increasing prevalence of cyberattacks has shifted the focus from solely protecting organizational data to safeguarding the digital well-being of employees. Organizations are recognizing that their employees are the first line of defense against cyber threats, and their personal cybersecurity directly impacts the company's overall security posture.

The Role of Employers in Protecting Employees from Cyber Threats

Employers have a vested interest in protecting their employees from cyberattacks. By providing necessary resources and support, organizations can:

- Mitigate reputational damage: A data breach affecting an employee can reflect negatively on the company's reputation.

- Reduce productivity loss: Cyberattacks can disrupt employees' work and productivity.

- Enhance employee morale: Demonstrating care for employees' digital well-being fosters a positive work environment.

- Strengthen overall cybersecurity posture: Educated and protected employees contribute to a more resilient organization.

Benefits of Offering Employee Cyber Benefits

Providing Employee Cyber Benefits can yield significant advantages for both employees and employers:

- Enhanced employee satisfaction: Demonstrates the company's commitment to employee well-being.

- Reduced employee anxiety: Provides peace of mind by offering financial protection against cyberattacks.

- Improved employee productivity: Minimizes disruptions caused by cyber incidents.

- Strengthened employer brand: Positions the company as a responsible and forward-thinking employer.

- Risk mitigation: Protects the company from potential liability arising from employee-related cyber incidents.

How Employee Cyber Benefits Can Help Mitigate Personal Cyber Insurance Frauds

While Employee Cyber Benefits primarily focus on prevention and protection, they can also play a role in mitigating personal cyber insurance frauds:

- Increased awareness: Educating employees about cyber threats and fraud prevention can help them identify and avoid scams.

- Early detection: Prompt reporting of suspicious activities can help prevent further damage.

- Support services: Insurance providers often offer fraud prevention and recovery assistance.

- Data privacy training: Emphasizing the importance of protecting personal information can reduce the risk of falling victim to social engineering attacks.

By implementing these strategies, organizations can create a comprehensive Employee Cyber Benefit program that protects employees, mitigates risks, and enhances overall organizational security.

An average policy for a single employee costs an employer between Rs. 50 and 1000 per month, depending on the level of coverage. That increases to Rs. 150 to Rs. 3500 per month to cover an entire family. Employers can also pay for a base level of coverage for employees and allow them to purchase more extensive coverage for themselves or their families.

Creating Effective Employee Cyber Benefit Programs

Developing a robust Employee Cyber Benefit program requires careful planning and execution. Key components of an effective program include:

Key Elements of a Comprehensive Employee Cyber Benefit Program

- Needs Assessment: Identifying the specific cyber risks faced by employees is crucial for tailoring the benefit package. The risks faced by employees vary for each industry. For example: Employees working in IT industry are at increased risk of breach compared to those in manufacturing setups.

- Coverage Options: Offering a range of coverage options to accommodate diverse employee needs, such as identity theft protection, data breach coverage, cyber extortion, and cyberbullying insurance.

- Benefit Communication: Clearly communicating the value proposition of the program to employees is essential for maximizing participation.

- Enrollment Process: Implementing a user-friendly enrollment process to facilitate employee participation.

- Claims Management: Establishing efficient claims processing procedures to minimize inconvenience for employees.

- Education and Awareness: Conducting regular cybersecurity training to empower employees to protect themselves from cyber threats.

Choosing the Right Insurance Provider

Selecting the appropriate insurance provider is critical to the success of an Employee Cyber Benefit program. Key considerations include:

- Financial stability: Ensuring the insurer has a strong financial position to meet claims obligations.

- Coverage breadth: Assessing the extent of coverage offered by the insurer.

- Claims handling efficiency: Evaluating the insurer's reputation for prompt and fair claims processing.

- Customer service: Considering the insurer's commitment to providing excellent customer support.

- Data privacy and security: Verifying the insurer's adherence to data protection regulations.

Cyber Perils that can be insured

Personal Cyber Insurance cover address a variety of distinct risks through difference Services.

- Identity Theft: Acquiring and using sensitive personal information for fraudulent activities like loan applications or car purchases. Services include online impersonation tracking and identity recovery assistance.

- Cyberbullying: Sending intimidating or threatening messages online, leading to emotional distress and potential employment consequences. Coverage may include psychiatric care, relocation, and digital forensic analysis.

- Social Engineering/Online Fraud: Cybercriminals using deception to trick victims into revealing personal information or transferring money. Coverage typically includes reimbursement for unauthorized charges.

- Cyber Attacks: Destruction of computers, data corruption, or impaired access to homes or home businesses. Coverage may cover data restoration, document recovery, and computer replacement.

- Cyber Extortion: Ransomware attacks demanding payment to unlock systems or prevent data destruction/release. Coverage can reimburse ransom payments (though this is often excluded or limited).

Additional Considerations:

- The specific services and coverage levels can vary between insurance providers.

- It's important to review policy details carefully to understand what's covered and any exclusions.

In essence, personal cyber insurance aims to protect individuals from the financial and emotional consequences of cyberattacks and online threats.

The escalating cyber threat landscape in India underscores the urgent need for individuals and organizations to prioritize cybersecurity. Personal cyber insurance offers a crucial safety net, while Employee Cyber Benefits provide a proactive approach to protecting employees. By understanding the evolving threat landscape, implementing effective programs, and fostering a culture of cybersecurity awareness, organizations can significantly enhance their resilience against cyber threats.